Save hundreds or even thousands on balance transfer cards.

Lock in a Balance Transfer of 0% and Knock Off Hundreds or Thousands in Interest – Apply at CreditSoup Excellent Credit Cards

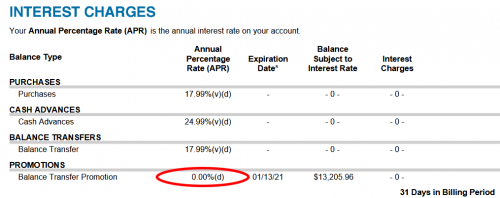

0% APR balance transfer credit cards are a great way to take advantage higher interest balances on auto loans, other credit cards or personal loans. Imagine the monthly interest you save on a 18% to 24% credit card with a $10-15,000 balance. $2400 in interest for a year comes out to $200 a month which you could be saving!

Reasons to do a 0% Balance Transfer Credit Card Offer

How long do 0% Introductory Rates Go For?

Are there Balance Transfer Fees Associated with a 0% APR Balance Transfer?

Benefits of balance transfer credit cards – should you get one?

What is a balance transfer credit card? A balance transfer credit card allows you to transfer your outstanding balances from one or more credit cards to a new card, often with a lower interest rate or promotional 0% interest rate for a limited period. Here are some potential benefits of using a balance transfer credit card:

- Lower Interest Rates: One of the main benefits of a balance transfer credit card is the potential to save money on interest charges. By transferring your high-interest balances to a card with a lower interest rate or a promotional 0% interest rate, you can reduce the amount of interest you pay and pay off your debt faster.

- Consolidation: If you have multiple credit cards with balances, a balance transfer card can help you consolidate your debt into one place, making it easier to manage and pay off.

- Improved Credit Score: If you’re able to pay off your balance more quickly thanks to a lower interest rate, you may see an improvement in your credit score. Paying off debt can help lower your credit utilization ratio, which is an important factor in your credit score.

- Simplified Payments: By consolidating your balances onto one card, you’ll only have to worry about making one payment each month, rather than managing multiple payments to different credit card companies.

- Rewards: Some balance transfer credit cards offer rewards programs, such as cash back or points for purchases. If you’re able to use the card for everyday purchases and pay off the balance each month, you can earn rewards while paying down your debt.

You’ll want to be aware of fees for transferring balances (typically between 3 and 5 percent), as well as interest rates that can increase after the promotional period ends. Additionally, opening a new credit card can potentially lower your credit score temporarily due to the hard inquiry on your credit report. Be sure to read the fine print and understand the terms and conditions before applying for a balance transfer credit card.