Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

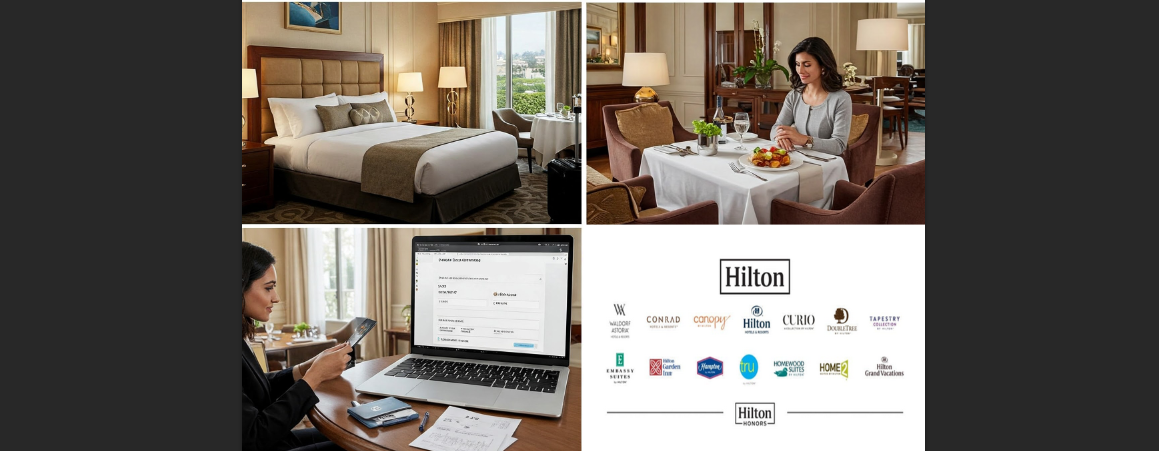

Business credit cards are often judged by their points and rewards programs, but the Hilton Honors American Express Business Card offers a hidden value many cardholders overlook: up to $240 per year in statement credits for purchases made directly with Hilton properties.

Rather than waiting for a once-a-year rebate or complicated redemption process, this benefit is straightforward—earn a $60 statement credit every calendar quarter when you make eligible Hilton purchases. Let’s break down how to take full advantage of this ongoing benefit.

What Qualifies for the $60 Quarterly Credit?

The credit applies to eligible purchases made directly with a Hilton hotel, resort, or property, including:

- Room rates

- Incidentals like Wi-Fi upgrades or late checkout fees

- On-site restaurants, lounges, or bars

- Spa services

- Valet parking or resort fees

Online bookings through Hilton.com, the Hilton Honors app, or by phone also qualify—as long as the charge is processed by Hilton, not a third-party booking site.

Practical Ways to Use the Credit Each Quarter

Here’s how cardholders can make the most of the quarterly $60 credit:

1. Book a One-Night Stay at a Lower-Cost Hilton Property

Hampton Inn or Tru by Hilton locations often offer rooms under $120. With the $60 credit, that stay is effectively cut in half—ideal for a quick business trip or weekend getaway.

2. Split Up a Multi-Night Stay

Planning a 3-night trip? Pay for one or two nights using your Hilton Business Card each quarter to trigger credits across multiple billing cycles.

3. Use It on Food or Services During a Stay

Already staying on points? Use your Hilton Business Card for in-room dining, hotel dining, or drinks at the lobby bar—and still trigger the statement credit, even if your stay was free.

4. Gift a Stay or Upgrade Someone’s Trip

If a family member or employee is traveling, you can prepay or cover part of their Hilton stay using your card and still qualify for the credit—great for small teams or family businesses.

Strategic Tips to Avoid Wasting the Credit

- Don’t wait until the last day of the quarter: Give yourself a week or more of buffer time to make the transaction.

- Set a calendar reminder at the start of each quarter to plan a qualifying Hilton spend.

- Use it in tandem with the Hilton Honors Gold Status benefit—stacking credits with free breakfast or room upgrades increases value. Upgrade your Hilton status while using your statement credits.

Real Value: A Business Credit Card that Offsets the Annual Fee

The Hilton Business Card carries a $195 annual fee, but if you maximize all four quarterly $60 credits, that’s $240 back—more than covering the fee before factoring in points, status perks, or other benefits.

Conclusion

The quarterly $60 Hilton credit might seem small on its own, but used consistently, it becomes one of the most reliable ways to reduce travel costs. With just a bit of planning, cardholders can turn routine spending into real savings—four times a year.

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Compare the top Excellent Credit Card Offers - CreditSoup Balance Transfer Cards